AFFORDABLE HOME COOPERATIVES: CREATING HOMEOWNERSHIP OPPORTUNITIES IN HOT REAL ESTATE MARKETS

This post is part of a lecture series I’ve conducted on affordable homeownership development and finance.

In the United States homeownership is a major vehicle for wealth accumulation. For many, it is the primary means of acquiring and maintaining economic mobility.

As described by Brookings: Wealth differs from income in that it serves three major purposes: (1) Wealth provides households with buffers during economic shocks. For instance during periods of unemployment, assets can be drawn down for emergency needs. (2) Wealth is a means for ensuring economic stability for future generations. (3) Finally, financial gains from personal assets are taxed at a lower rate than wages.

Unfortunately, for many Americans the accumulation of wealth and its benefits through homeownership are out of reach due to highly speculative real estate markets, socioeconomic factors or race.

Among prospective first-time buyers highly speculative real estate markets has pushed homeownership further and further out of reach. Renters seeking homeownership are seeing an increase in household expenses especially in, well…rent! This makes it difficult for households to stash away savings for a downpayment on a home. As recently reported by the Washington Post, dozens of major cities across the nation are seeing annual costs and rental costs rise by 30% percent — for instance 34% increase in rents in Fort Lauderdale, 35% in New York City and 40% in Austin, Texas.

For Millennials and younger generations, homeownership is becoming less and less attainable.

Just as rents are skyrocketing, home prices are also through the roof. As reported by the National Association of Realtors, the

median price for a single-family home $358,000.

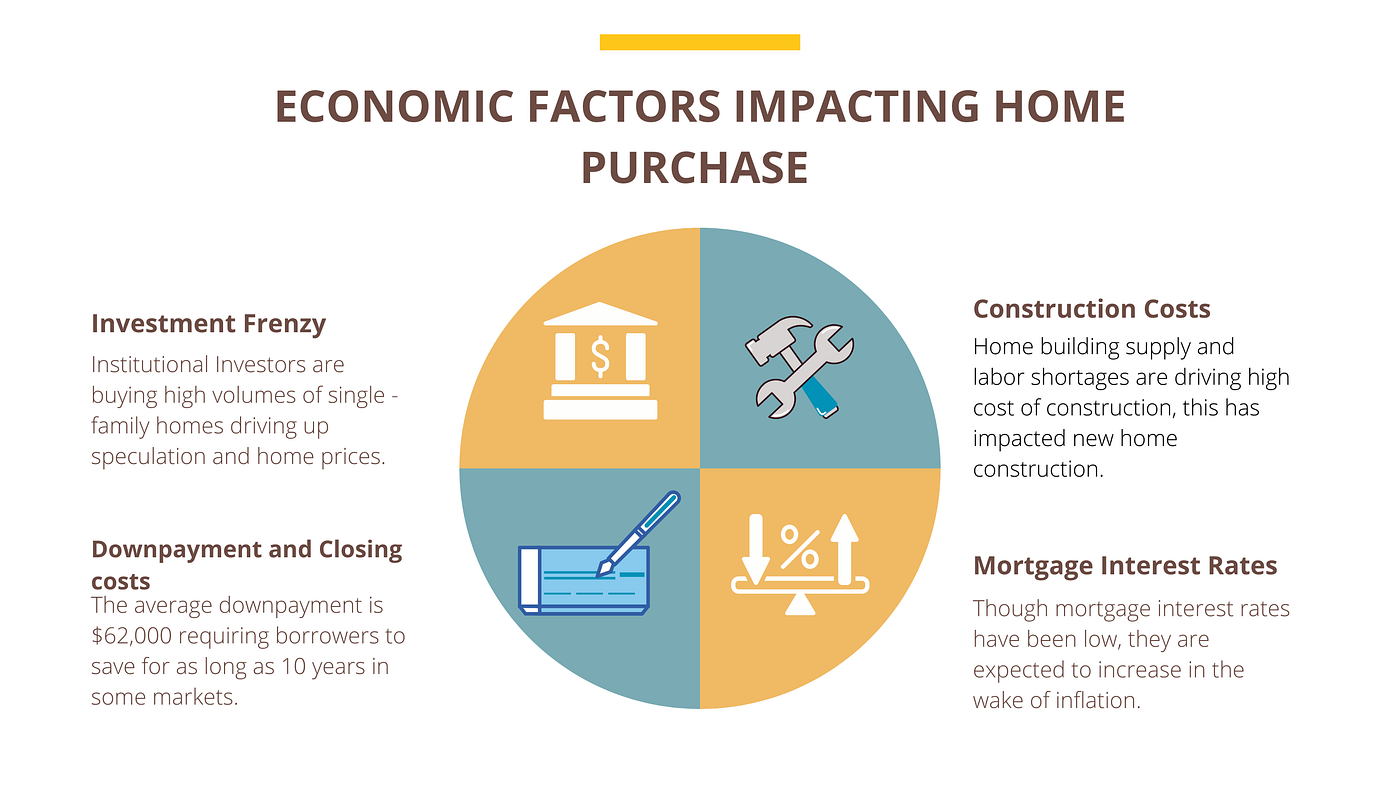

Economic Factors Impacting Home Affordability

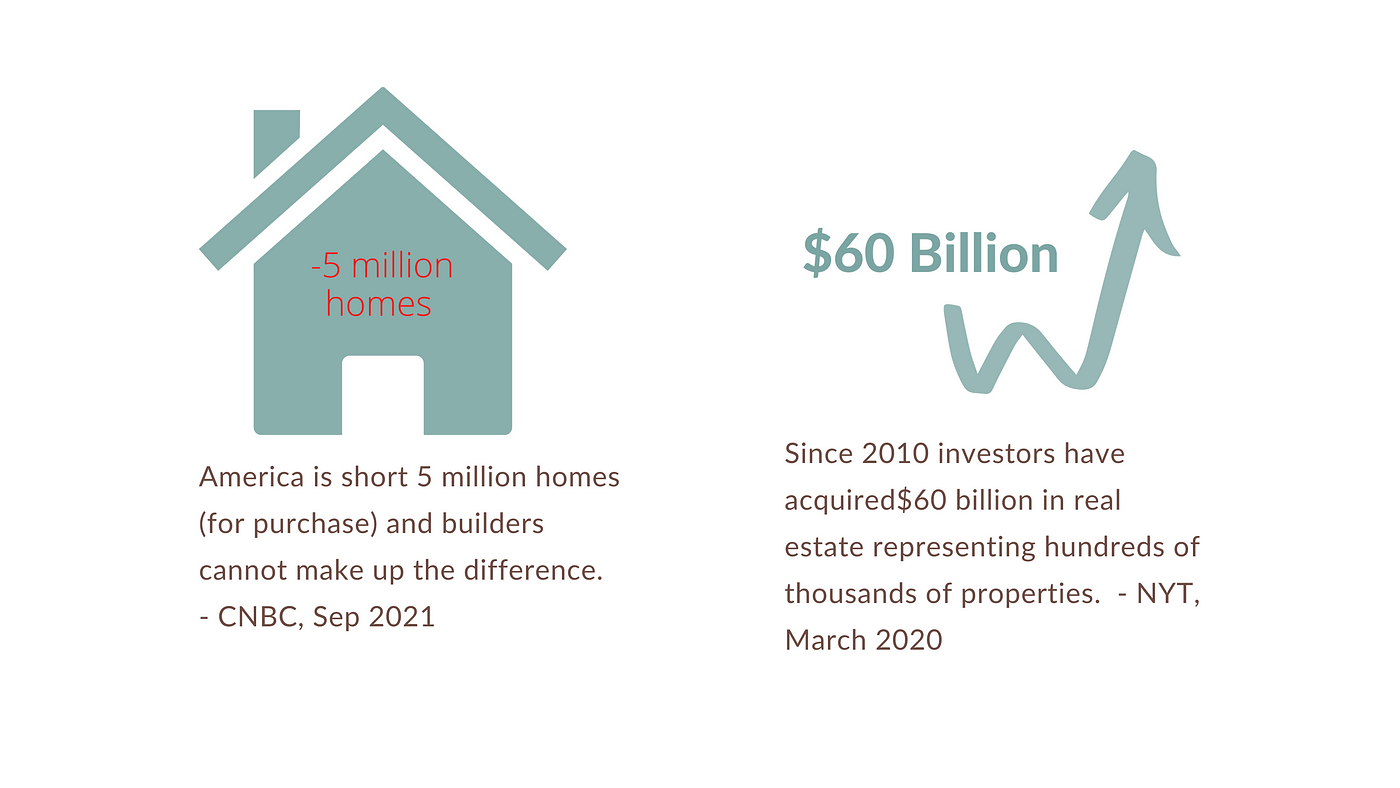

Home Supply Deficit

In a nationwide survey of nearly 7,000 prospective homebuyers, researchers at Point2 found that 74% of Millennials who are interested in purchasing a home would like to do so in the next 12 months. However, 88% of respondents ages 25 to 40 have significantly less in savings than the average national down payment amount.

In 27 Markets, Millennials Need 5–10 years to save enough for a downpayment.

For Millennials and younger generations, homeownership is becoming less and less attainable.

This age group has suffered through two major economic recession since entering the labor force and are reported to not have benefited from the earnings and savings of prior generations at their age.

Advocacy and persistence among elected officials, local housing agencies community-based and mission-based private sector developers are needed to expand affordable homeownership development activity as well as affordable housing overall.

Racial Discrimination Exacerbates the Issue

Even for renters who could potentially afford a home, housing discrimination and systemic racism keeps homeownership out of reach.

In 2019 New York Newsday published the results of athree-year undercover investigationwhich found widespread evidence of unequal treatment by real estate agents in Long Island, NY. Recorded interactions with 93 real estate agents showed blatant violations of fair housing laws with Black homebuyers 49% likely to be treated unequally; researchers reported unfair treatment of Latinos at 39% and Asians at 19%.

Investment in Local Community-Based Homeownership Development

For decades community-based nonprofit developers and mission-based for profit developers have been instrumental in building and preserving housing for low- and moderate-income households — including affordable homeownership.

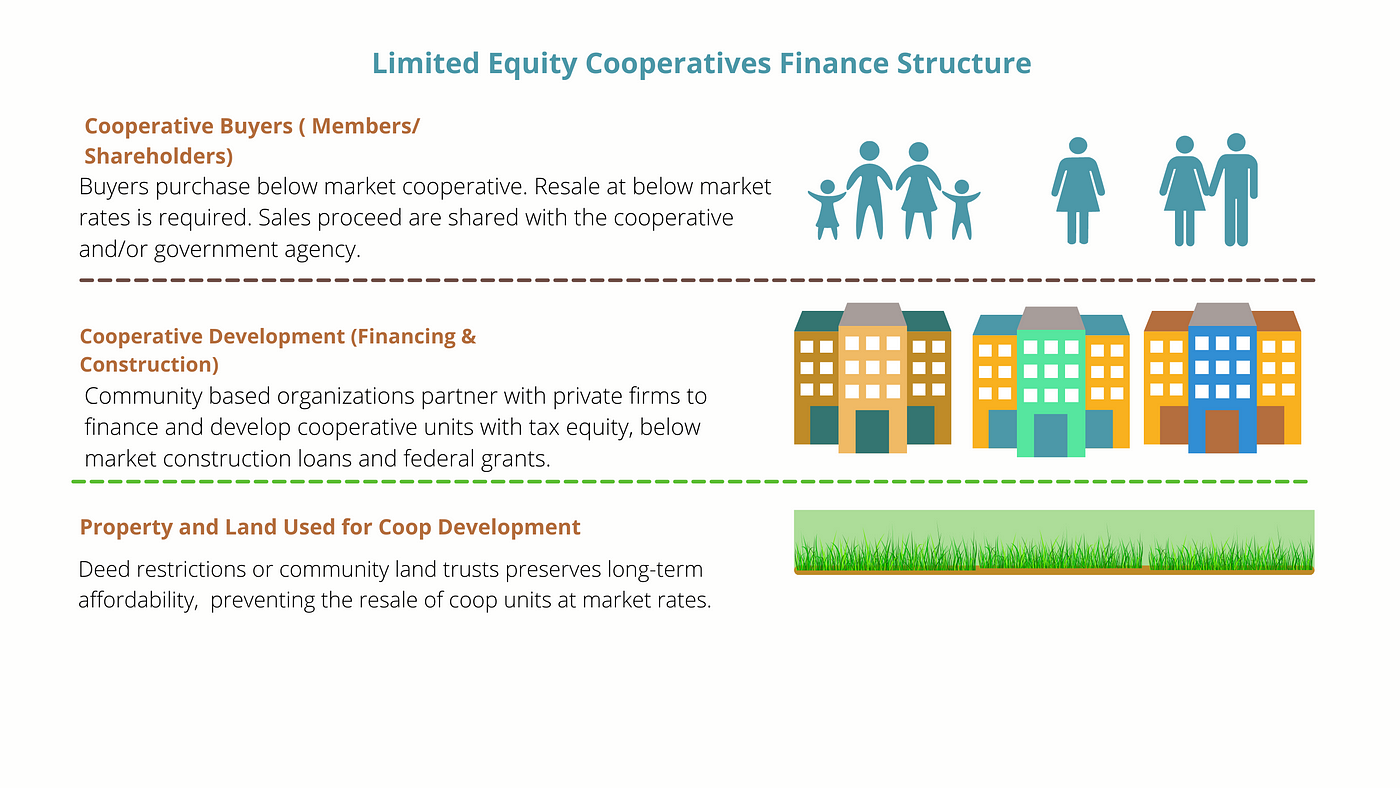

In dense urban areas like New York City, cooperative development and homebuyer downpayment assistance can make purchasing more feasible for many. Though many housing coops units can sell very high on the open market, affordable homeownership typically targets working households earning at or below 80% of HUD’s area median income. Deed restrictions or community land trusts protect affordability long-term. Real estate tax abatements can substantially reduce expenses.

There are also housing cooperatives developments targeting moderate and middle-income first time buyers. These developments still offer below market purchase options, but unlike the limited equity cooperatives — buyers of these cooperatives have the opportunity accumulate and capture equity after a period of time. Subsidies on these projects are treated as a lien or as a forgivable mortgage. Deed restrictions and tax abatements are temporary for these projects.

Expanding Affordable Housing Cooperative Opportunities

Unfortunately, affordable projects and programs currently in the pipeline are no where near filling the gap in need. In fact, the need is so great, that developers use lotteries to select buyers.

Advocacy and persistence is needed among elected officials, particularly congressional leaders who can expand subsidies for homeownership development, and ease restrictions for federal grants. At the local level, housing agencies community-based and mission-based private sector developers can identify underutilized public and private property to expand affordable homeownership development activity as well as affordable housing overall.

Environment, climate resilience and social determinants of health are taken into consideration in affordable homeownership developments. For instance, in some cities, like New York all new major housing developments, including homeownership developments, require sustainability measures which reduces carbon emissions, while reducing energy and water usage and costs.

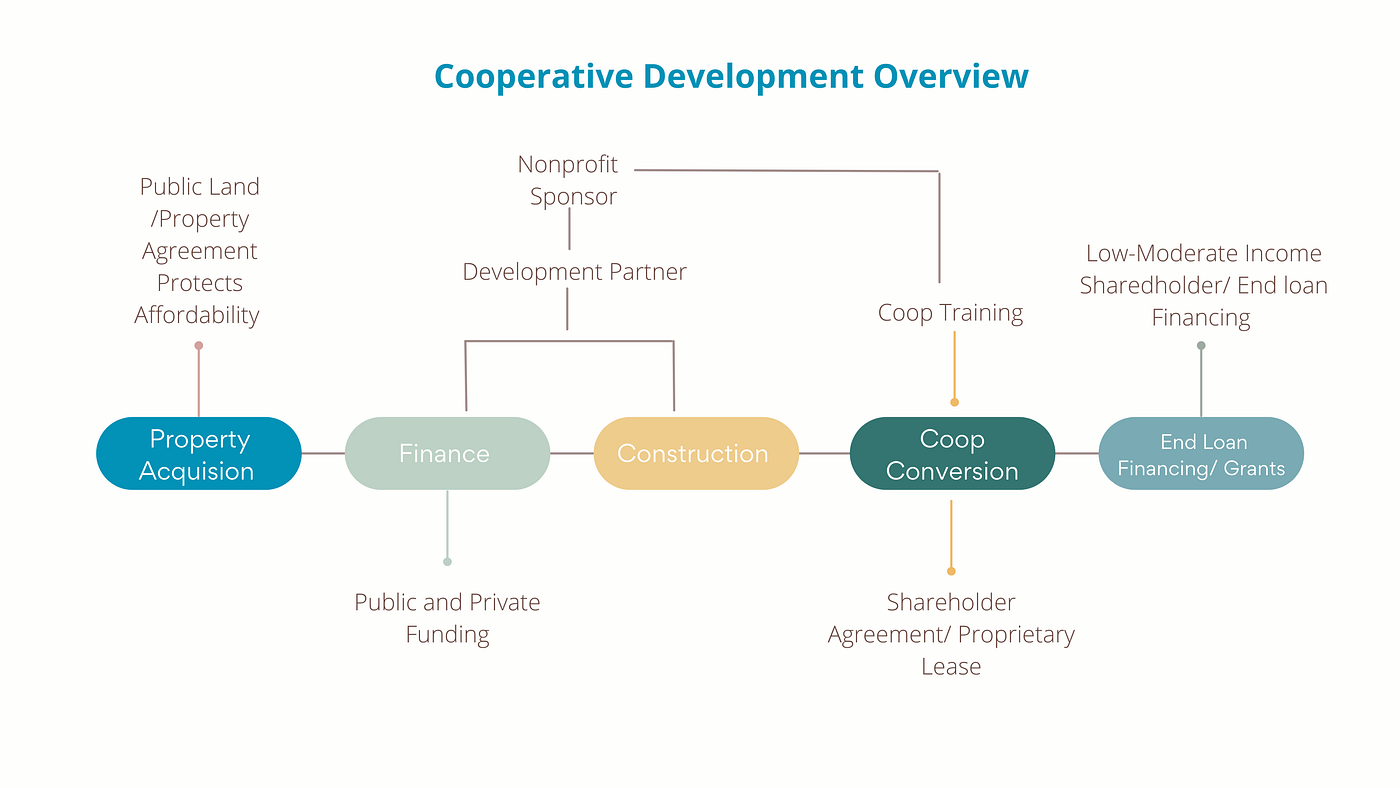

The diagrams below describe key aspects of affordable cooperative development. In most cases a mix of public and private funds are needed. An allocation of federal and state funding makes a project attractive to banks and investors that have below market rates and termsfor affordable housing development.

There are hundreds of affordable cooperative developments across the United States. And even in other parts of the world like Europe. I have toured homes in Slovenia for instance where 92% of apartments are privately owned. In NYC we have worked on securing funding for construction for affordable multi-family homeownership 1–4 family homes and cooperatives. I have worked with nonprofit developers secure and disperse funding for first-time homebuyer grants and low-cost end loans for the final purchases.

Homeownership is key to economic and social mobility for many Americans. It protects low- and moderate-income families against displacement due to gentrification. There are many avenues for creating homeownership opportunities across income levels. As we look towards rebuilding the economy with a focus on equity, we should explore as many avenues as possible to make homeownership a viable opportunity for as many citizens as possible.